Why Your Card Was Declined: Common Reasons and What to Do About It

Why Your Card Was Declined: Common Reasons and What to Do About It

I bet you’ve been there before: You’re at the checkout, ready to pay for your groceries, or maybe you’re online buying something special, and when you go to make the payment—oh no! Your card gets declined. It’s embarrassing and stressful, right? But don’t worry, it’s something that happens to many people. Let’s dive into why your card might get declined and what you can do about it.

Understanding Why Your Card Was Declined

There are a host of reasons why your card might get declined. Here are some of the most common:

1. Reached Credit Limit or Insufficient Funds

The most straightforward reason is that you’ve maxed out your card. If you’re using a credit card, this means you’ve reached or even exceeded your credit limit. For debit cards, it means you don’t have enough money in the corresponding bank account.

[插图:银行卡额度已满]

2. Incorrect Payment Information

Sometimes, it’s just a simple mistake. Entering the wrong card number, expiration date, or security code can be an easy slip-up, especially when you’re in a hurry or shopping online.

3. Suspicious Activity

Your bank might see something unusual and, out of an abundance of caution, block the transaction. This often happens if you’re traveling or making a purchase that doesn’t fit your usual spending habits.

4. Card Expired

Every card comes with an expiration date. Make sure yours is still valid! If it has expired, your bank might have already sent you a new one.

5. Fraud Protection

Banks sometimes block transactions they suspect could be fraudulent. Large or unusual transactions may trigger this safety feature, leaving you momentarily unable to use your card.

6. Holds or Blocks

Places like hotels and car rental services can put a temporary hold on funds to ensure you can cover the bill. If the hold amount is large, it might limit your available credit or funds.

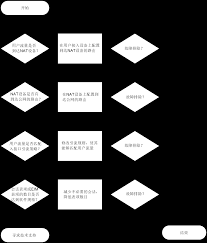

Steps to Take When Your Card is Declined

So, what should you do when your card is declined? Here are a few steps to follow:

- Check your details. Make sure you entered all the card information correctly.

- Contact your bank. Give them a call to find out why the transaction didn’t go through.

- Try another card. Use a different card if you have one to complete your purchase.

Preventing Future Issues

While having your card declined can be frustrating, there are ways to prevent it from happening again:

- Monitor Your Spending: Keep an eye on your account balance and credit limits. This can be done easily through banking apps or online banking.

- Update Contact Information: Ensure your bank has your current address, phone number, and email. This avoids missing important communications.

- Notify Your Bank Before Traveling: Let your bank know about your travel plans to avoid triggering the fraud alert systems.

- Set Up Alerts: Many banks offer alert features to notify you if your balance gets low or if there’s suspicious activity.

Frequently Asked Questions

1. What should I do if my card gets declined?

First, verify the information you entered is correct. If the problem persists, contact your bank’s customer service for detailed information and support.

2. Why does my card get declined even if I have money in the bank?

This could be due to factors like suspected fraud, a block placed by the merchant, or holds on your account. It’s always best to reach out to your bank to get to the bottom of it.

3. How can I avoid my card being declined when traveling?

Notify your bank of your travel plans ahead of time so that they know not to flag transactions from unusual locations as suspicious.

4. What happens if my card is declined during an emergency?

Always keep a backup payment method, like cash or another card. If you find yourself in an emergency without access to funds, contact your bank immediately for assistance.

5. Can a bank refuse to explain why a card was declined?

Banks generally will provide an explanation but may withhold some information for security reasons. It’s best to contact them directly and ask for as much detail as they can provide.

Conclusion: Stay Informed and Prepared

Understanding why your card was declined can help you prevent future issues. Pay attention to your funds, keep your information updated, and always have a backup payment method. By staying proactive, you can shop confidently without the embarrassment or frustration of a declined card.

Next time you pull out your card, you’ll know what to do if something goes wrong. It’s all about being prepared and informed!